Past performance is not indicative of future results. Alpha Seeker and Smart Index returns from sample accounts, net of 1% fee.

A December to Remember

For the first time in the nearly 100-year history of the S&P 500, December became the worst month of the year for stocks in 2018 as the S&P 500 shed -9% after sliding to nearly -15% MTD on Christmas eve. A far cry from the double-digit YTD pace in October, a brutal 4th quarter dragged the stocks into the red for the year with the S&P 500 slipping -4.4% in 2018.

The VIX reaction was again relatively muted, but sufficient enough for Alpha Seeker to post its best month of the year in December and for Smart Index to add 400 basis points to its already substantial YTD lead over the S&P. Both strategies finished 2018 with single-digit gains.

When Nothing Works

The appealing logic of low-cost exposure to the long-term upward trend in stock markets continues to attract billions of dollars to indexing strategies. While the merits are clear during strong markets like we’ve seen in recent years, cracks begin to show when indexes falter and the “long term” view takes a back seat to “do something” about short-term realities.

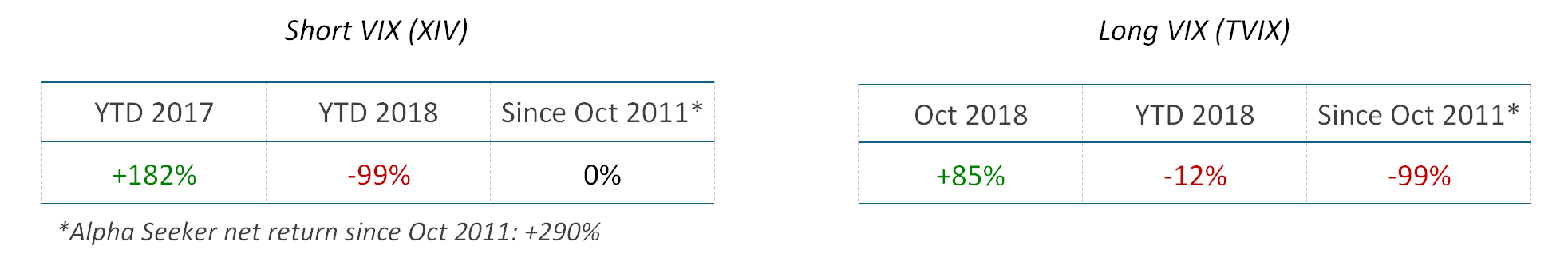

In liquidation periods like this year when EVERY index struggles, portfolios can be insulated from the risk of costly emotional decisions with an exposure that does not depend on rising asset prices. Volatility strategies can fit the bill, but unless they are flexible and can adapt to the current market environment they may actually increase risk and fail to provide the desired insulating effect. Our strategies were designed with this in mind and we’re excited to continue demonstrating their value for our clients in the years to come.