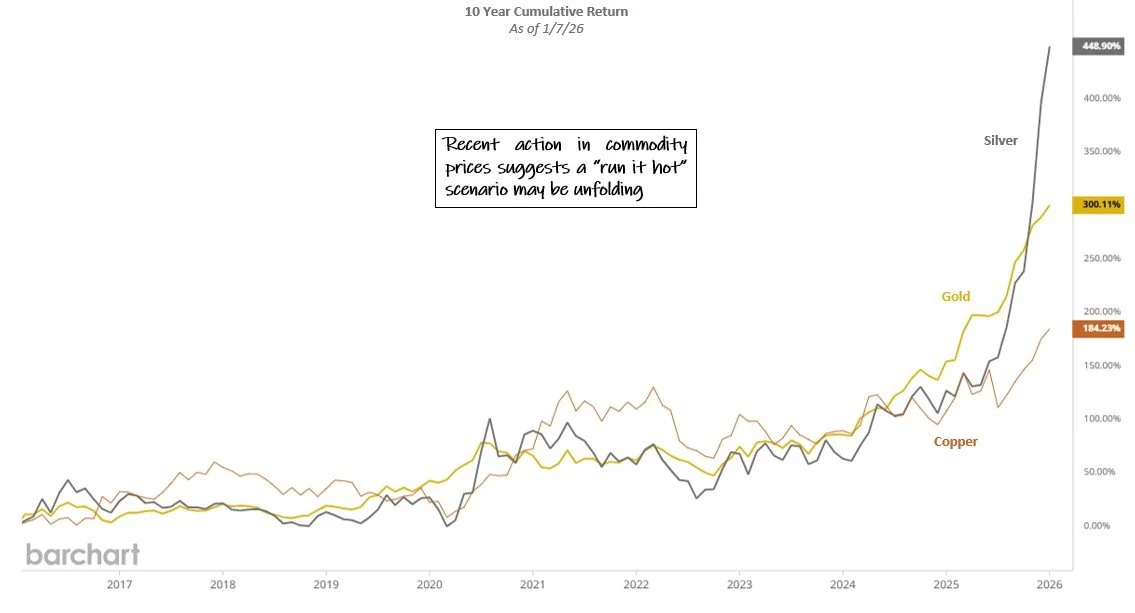

After a solid year for equities in 2025, recent action in commodities suggests the market may be considering a “run it hot” scenario that could devalue the dollar and produce further gains in 2026. Of course there are no guarantees and with stakes this high, we believe a tactical approach remains the best way to extract and preserve value.

2025 Year In Review

As outside forces created step-changes in fundamentals that yanked markets in every direction, 2025 served as a good reminder that shielding portfolios from only the truly harmful equity drawdowns delivers a much better cost–benefit tradeoff than hedging every dip. With an evolving set of factors that may combine in positive or negative ways, investment flexibility remains key for 2026.