Hot Pursuit

S&P 500 Tech Sector return composition. Source: Goldman Sachs. Click for larger image

A quiet December capped solid gains for global equities in 2025 with a weaker dollar creating particularly strong returns in foreign markets (MSCI Emg Mkts +33.6% YTD, MSCI EAFE +31.2% YTD) while the “AI” buildout frenzy helped boost US indexes (Nasdaq 100 +20.2% YTD, S&P 500 +17.9% YTD).

Defying the “bubble” narrative, valuations in the the S&P 500 tech sector actually fell in 2025 as gains were more than fully explained by earnings and dividends (chart).

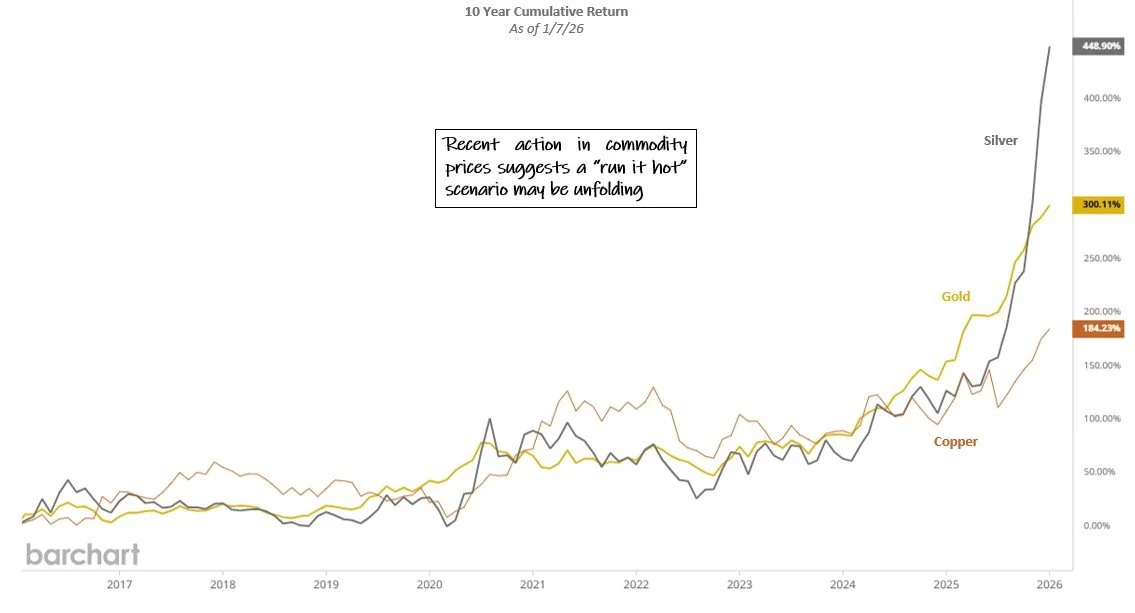

With silver prices spiking 23% in December alone, recent action in commodities suggests the market may be considering a “run it hot” scenario in which pro-cyclical monetary and fiscal policy merges with an already robust economy to create sustained inflation that raises asset prices, especially in government-supported industries and in historically cyclical areas such as emerging markets and semiconductors.

Front month futures 10 year returns as of 1/7/26. Source: barchart.com. Click for larger image

Beyond the general boost to US index exposures of Tactical Beta and Tactical Q, the “run it hot” scenario could be especially beneficial for the current pro-cyclical tilts in Legacy Navigator or for the more concentrated exposures of Hedged Disruptor or Emerging Mkts Smart Index.

Of course, there is no guarantee that this scenario comes to pass. Besides the political risks involved, a market revolt in the form of spiking bond yields could easily throw cold water on the project while creating new instability of its own.

With the Fed on an easing path and fiscal policy expected to be full-throttle ahead of the US midterm elections and the 250th anniversary of America’s founding this summer, “run it hot” may well be underway but with stakes this high, we believe a tactical approach remains the best way to extract and preserve value.