Hi Ho Silver

Evidence of the “run it hot” scenario discussed last month was apparent in January as precious metals, cyclical sectors and non-US equities substantially outperformed large cap US indexes on the month (chart) with particularly extreme volatility in silver prices that rose as much as 64% on the month before plummeting 31% in a single day on Jan 30th.

YTD Return as of 1/31/26. Source: barchart.com. Click for larger image

Interrupting the month’s bullish trend, trade (Greenland, Canada) and geopolitical (Venezuela, Iran) threats surfaced again in January, briefly prompting protective positions in TCM portfolios around mid-month that ultimately resulted in modest hedging expense after markets resolved in the classic pre-crisis shallow “V” pattern.

bond villian

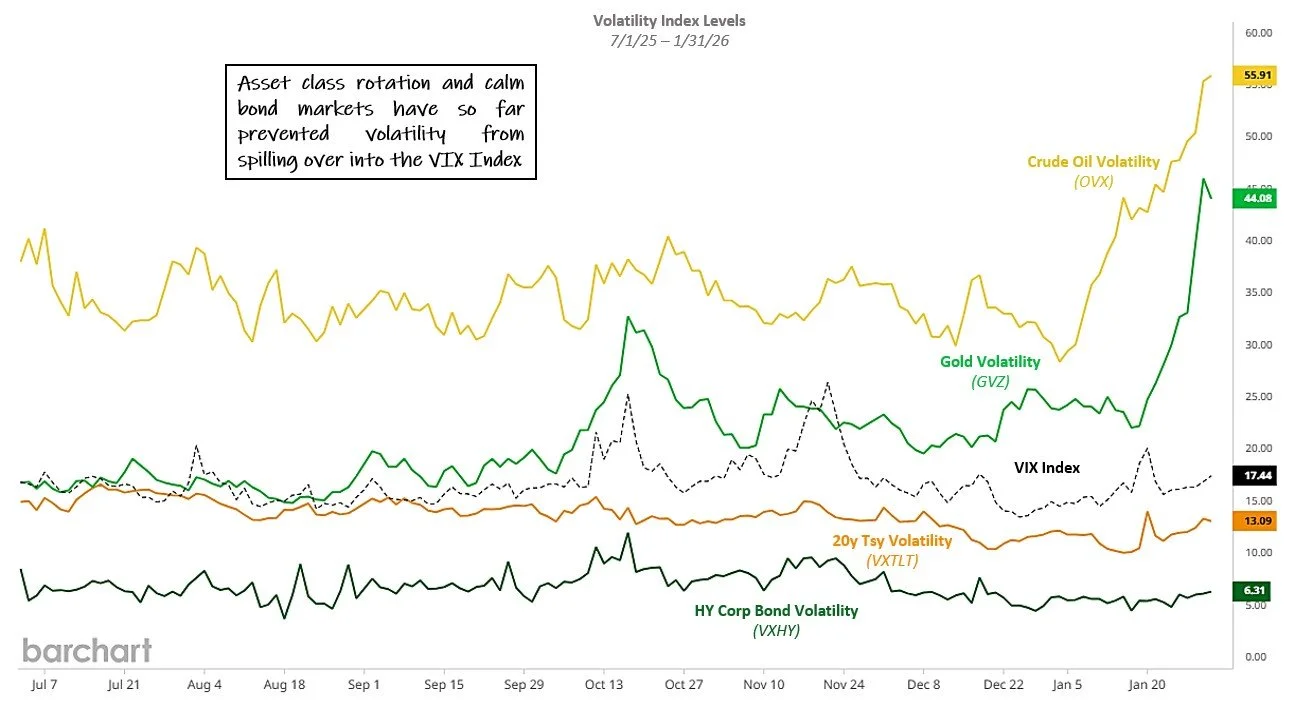

Increasingly, trade and geopolitical issues seem to be taken less seriously by investors and in our experience, the next true crisis is more likely to originate in the bond markets. So far, volatility has been confined largely to cyclical asset classes and typical of these rotation periods, hasn’t yet spilled over into the VIX Index which gauges overall market volatility.

Importantly, bond markets have remained relatively subdued (chart) but of course, this is subject to change and any spike in correlation or bond market volatility could well lead to more crisis-like conditions for stocks in the future.

Select volatility indexes Jul 2025 - Jan 2026. Source: barchart.com. Click for larger image

Indeed, recent headlines on private credit exposure to sub-prime auto and AI-threatened software companies could be the first inkling of just such an issue but as always, we will leave the prognosticating to others and watch the VIX marketplace for signs of an imminent crisis. Until that time comes, our focus will be on staying out of the way of rising markets.