From Panic Selling to Panic Buying

Past performance is not indicative of future results. Smart Index and Alpha Seeker sample accounts, net of 1% fee

January’s about-face from the Fed was enough to lift the S&P 500 from its worst December since the Great Depression to its best January in 30 years. Given this extreme movement, the VIX complex never fully normalized in January, even as the S&P recouped a large portion of December’s losses. In the end, Alpha Seeker finished the month modestly lower while Smart Index rose with the market after abandoning hedges early in the month.

Despite January’s excitement, the wild ride of the past two months has amounted to a -1.7% loss for the S&P 500, while Smart Index is roughly flat and Alpha Seeker has managed a gain of +2%.

Fight Volatility With Volatility

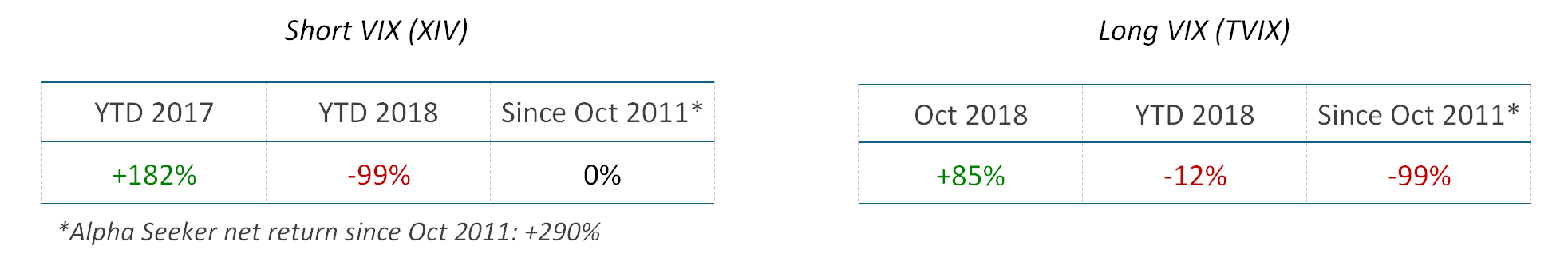

Time and again, turbulent market periods highlight the need for a volatility “buffer”, especially inside portfolios with significant exposure to equity indexes. Such a buffer not only reduces the risk of costly emotional reactions, it can actually lead to better outcomes over time. In other words: even a small allocation to the right non-correlated exposure can make an investor’s experience both less stressful and more profitable.

For example, in the period between Oct 2018 and Jan 2019, adding 10% Alpha Seeker to a standard 60/40 balanced portfolio improved return, lowered volatility and reduced the maximum monthly drawdown- even during a period when Alpha Seeker returned a small loss.

Past performance is not indicative of future results. Hypothetical portfolios, rebalanced monthly. Alpha Seeker returns from sample account, net of 1% fee

When reviewing Alpha Seeker’s entire track record of consistent positive annual returns, the same 10% allocation has provided a substantial return or volatility improvement over a standard 60/40 balanced portfolio in each of the past 7 years.

With economic and political uncertainty on the rise after several years of relative calm, now more than ever investors need to take steps to manage risk in their portfolios. Nobody knows what the future holds, but with the right tools, advisors and their clients can be better prepared for whatever lays ahead.