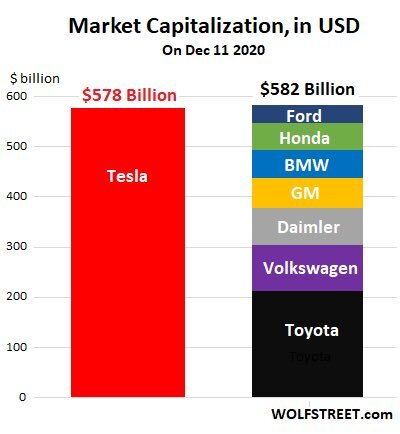

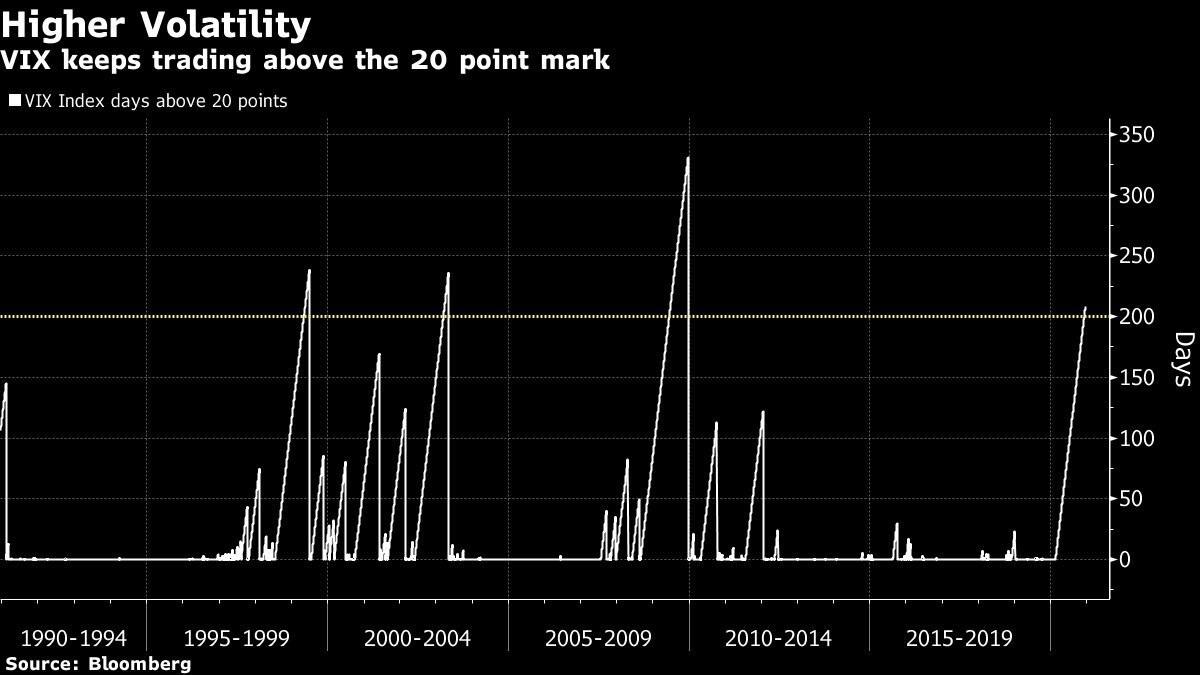

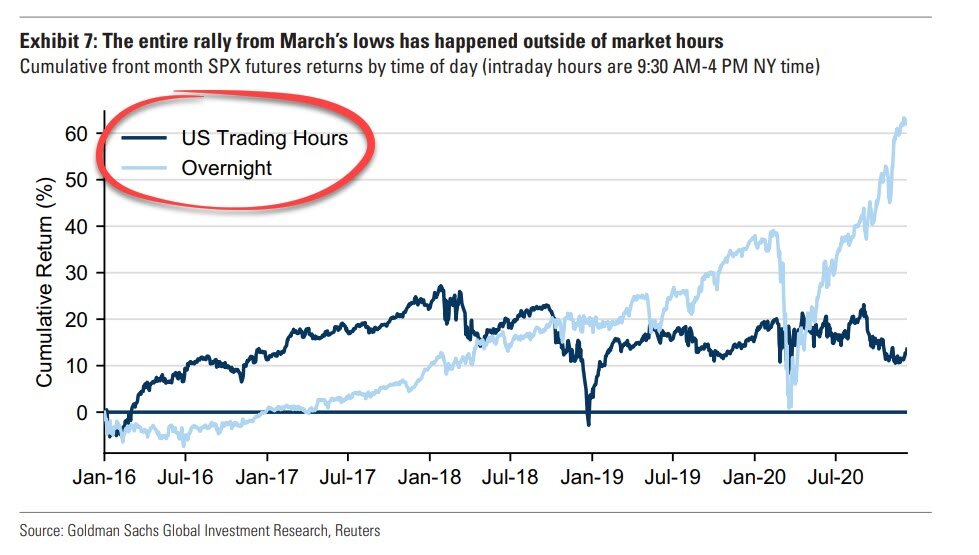

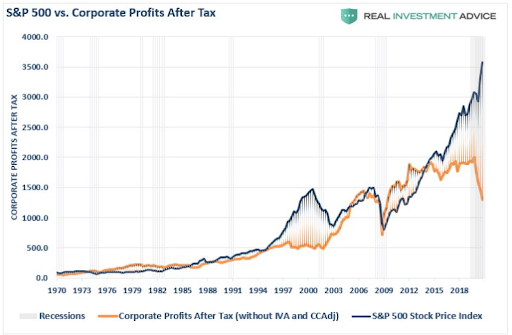

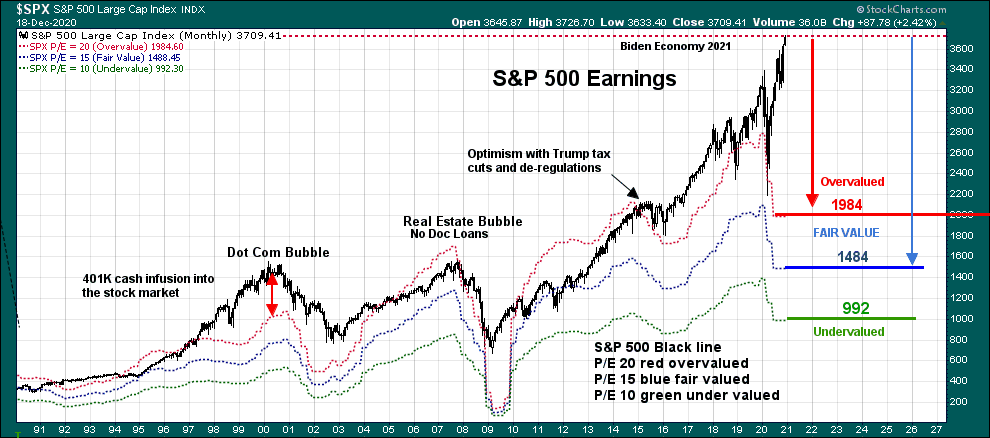

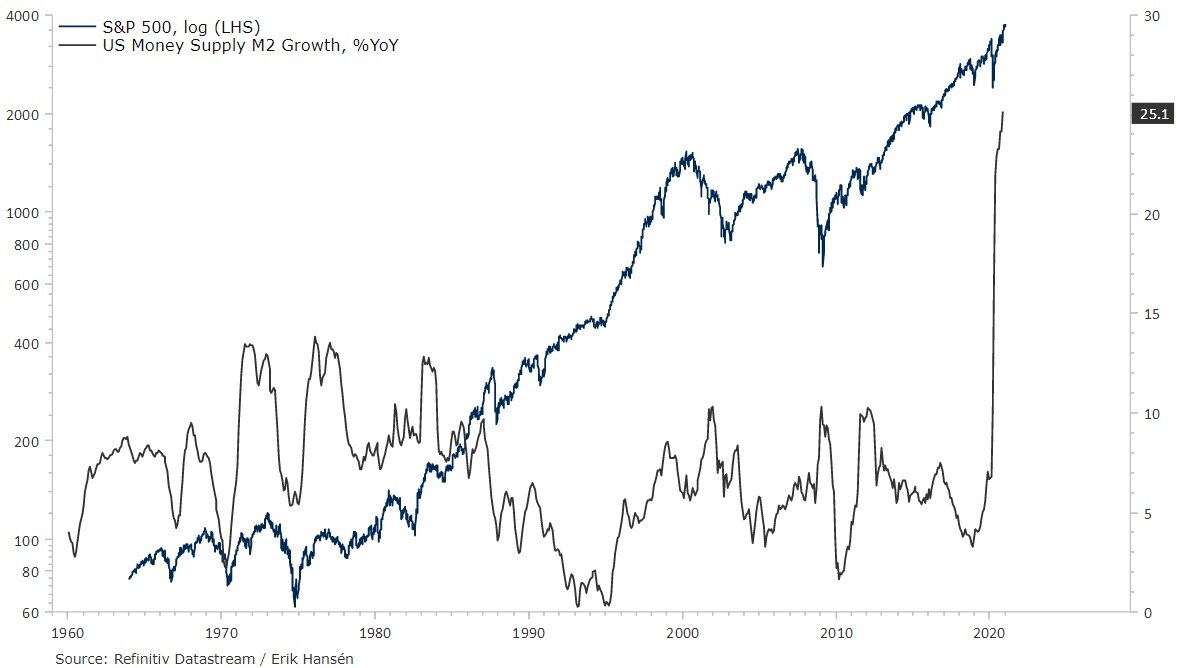

Stock markets at all time highs despite a record contraction in the economy. Yields near all-time lows while debt explodes worldwide. Many of the year’s hottest IPOs have never posted a profit, with one even disclosing that it doesn’t ever expect to make one. From a fundamental perspective, nothing about 2020 made much sense. See the gallery below for other assorted oddities:

Fortunately, our process is about responding to markets as they are, not as we think they should be. Conviction can be useful when investing, but in a nauseating year that saw markets ricochet from the fastest bear market in history to one of the most spectacular recoveries of the past century, flexibility was key.

Focused on the message from the VIX as the “Corona Crisis” unfolded, TCM strategies each made timely moves from defense to offense during 2020, protecting capital during the first quarter shock before moving to capitalize on the sharp recovery over the balance of the year. In the end, all strategies posted solid gains in one of the best all-around years for TCM strategies in the past decade.

Alpha Seeker: on target

Its fact sheet describes Alpha Seeker (+14.0% YTD) as “an absolute return strategy that seeks to deliver uncorrelated returns for purposes of portfolio diversification”. Right on target through a challenging year for tactical strategies, Alpha Seeker returned mid-double digits in 2020 with just 0.28 daily correlation to the S&P 500 index.

From the lowest to the highest VIX readings in history over the past decade, Alpha Seeker has proven to be a powerful diversifying exposure that can act like a hedge during crisis periods (+11% in March 2020), but also provide return in calm markets (+23% in 2017) when dedicated hedges often suffer substantial losses. More than just its attractive “right tail”, this profile subtly adds unique optionality that can improve the risk / reward tradeoff of a traditional diversified portfolio. (see table below)

Hypothetical portfolios comparison, Oct 2011 - Dec 2020. Rebalanced monthly, Alpha Seeker returns net of 1% management fee. Click for larger image.

Smart Index Family: a record year

In one of the most challenging environments in recent memory, Smart Index (+56.0% YTD) and the Legacy Navigator model (+26.3% YTD) recorded their best years since inception by deploying protection during the crisis and just as importantly, shelving it during the ensuing rally. Notably, the record 2020 results were produced in both strategies with less than 100% up-capture, the hallmark of an investment approach that seeks better results through limiting losses rather than magnifying gains. Going into its fifth year, the results of this strategy speak for themselves (see below).

Returns comparison, Nov 2016 - Dec 2020. Smart Index net of 1% management fee. "Hedged Equity Peers" is an equally-weighted composite of JP Morgan Hedged Equity (JHEQX), Swan Defined Risk (SDRIX) and Gateway Fund A (GATEX), rebalanced monthly.

In addition to the launch of Smart Tech in May this year, we are happy to announce two more additions to the Smart Index family covering MSCI EAFE (+25.7% YTD) and Emerging Markets (+19.4% YTD) indexes. Both strategies have been running with live money since Nov 2016 and have already built compelling 4-year track records, substantially outperforming their benchmarks since inception through superior risk control. With foreign indexes finally showing signs of life in late 2020, the time may be right to consider risk-managed exposure with Smart Index.

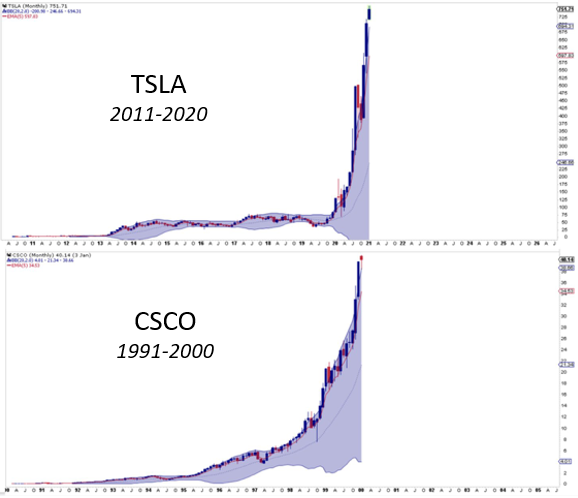

Hedged Disruptive Innovation: in the sweet spot

Hedged Disruptive Innovation (“Hedged DI”) began in August 2019 as a pilot program for applying tactical VIX hedging to a high-beta growth equity portfolio. TCM’s first departure from index-level investing, Hedged DI is a concentrated equity portfolio that carries significantly more risk than broad equity indexes but when used appropriately, may have a place in some portfolios.

Benefitting from the same defensive moves described above and benefitting from a tech-heavy portfolio firmly in the “sweet spot” for the current monetary and economic regime, the strategy returned an astounding +207.5% in its first full year.

Growth of $1000, Aug 2019 - Dec 2020. Hedged DI returns net of 2% management fee.

Thank you to all who helped make 2020 a success in spite of the difficult circumstances. If you haven’t done so already, be sure to schedule a webinar to learn how we can grow together in 2021!