steady as she goes

VIX futures prices, April 2021. Source: vixcentral.com. Click for larger image

Volatility continued to normalize as equity prices pushed higher in April, supported by strong earnings reports and ongoing accommodation from the Fed. Absent some turbulence around news of a Biden tax plan that would see capital gains rates at their highest levels in decades, a message of calm from the VIX meant positive beta exposures and positive returns for TCM portfolios throughout the month.

Benefitting from a “mini rotation” back towards growth names, Hedged Disruptor (+6.3%) and Smart Tech (+6.2%) led the way in April, while all other strategies saw continued gains including US Equity Smart Index (+5.6%) which now stands at +12.7% on the year vs +11.8% for the S&P 500, extending its lead on the index after an outstanding 2020. Not just a US phenomenon, each strategy in the Smart Index family is ahead of its benchmark on the year through April with less volatility.

swarm of flies

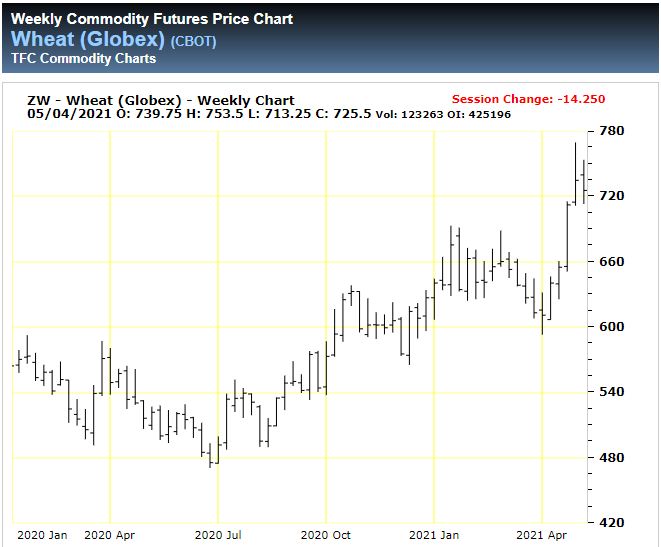

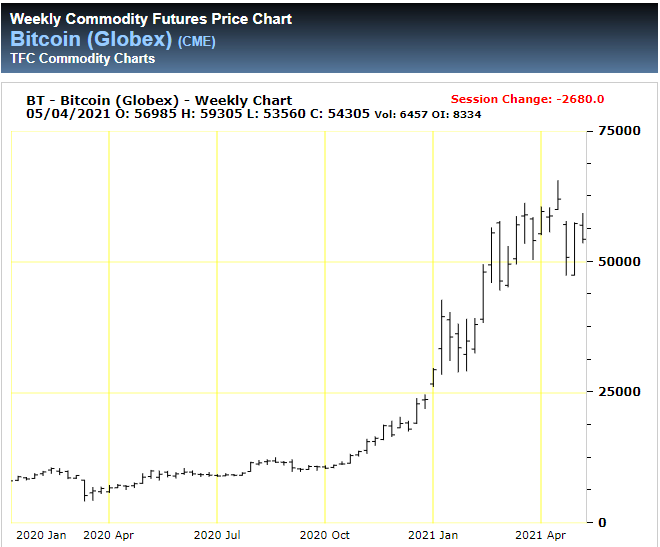

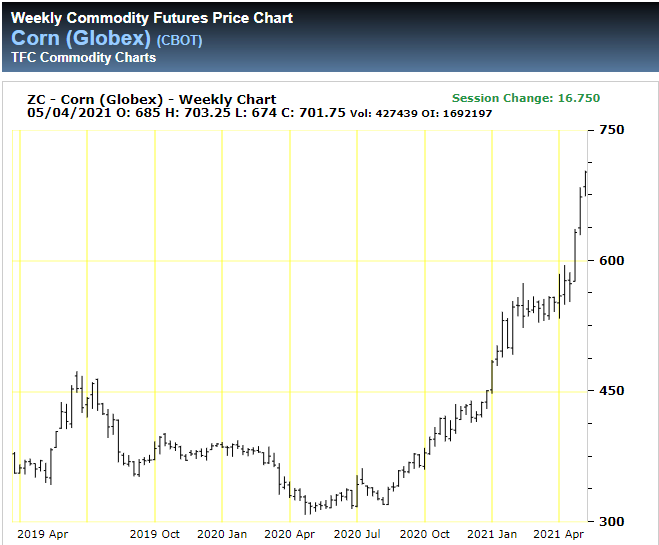

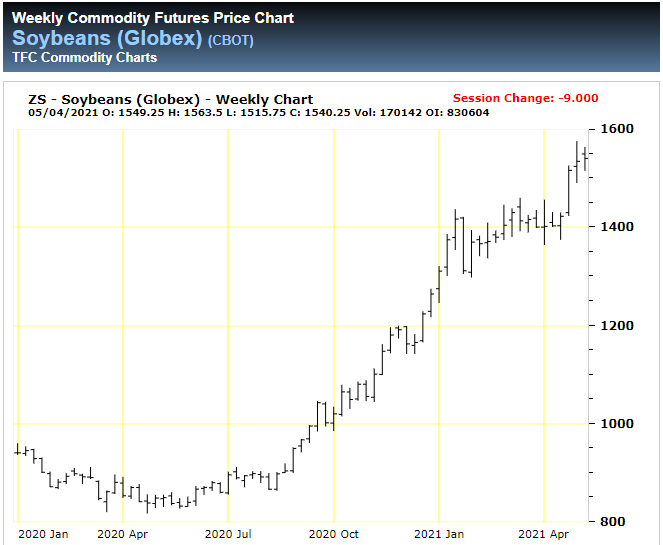

As stocks continue to bask in the glow of highly accommodative monetary policy, a potential “fly in the ointment” may be on the horizon. While the Fed has repeatedly declared their willingness to temporarily let inflation run over their 2% target before raising rates, recent movements in many major commodities and alternative currencies (see gallery below) appear ready to test that statement.

As we saw earlier this year, even a mild rise in rates can cause major ripples in the equity markets of highly leveraged economies like the US. While Fed-induced episodes like in Q4 2018 can be reversed with a rate cut or two, containing an inflation-driven spike requires bold and difficult (ie, market-unfriendly) action that seems to be in short supply at today’s Fed.

This is simply an observation of one of the myriad of factors that might affect markets. Nobody (including us) knows if this will be “the” issue or even an issue at all for stocks, so we will remain focused on the message from the VIX to help guide us through whatever comes next.