One Price TO rule Them All

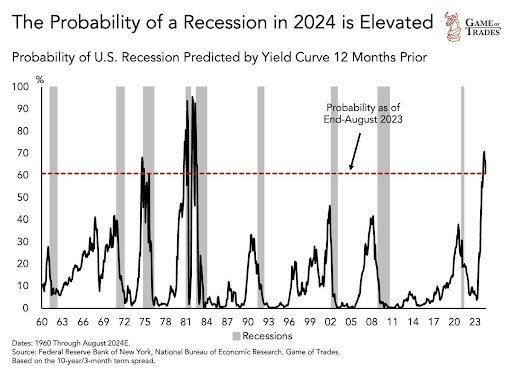

In a highly leveraged and financialized modern economy, the price of any asset is ultimately a function of the price of debt. As the quasi-governmental body tasked with setting interest rates, decisions made by the Federal Reserve therefore carry enormous weight for the stock market which has historically risen with economic progress over time, but in a repeating cycle of recessions and crisis periods created by monetary policy (chart).

Fed Funds y/y Change, S&P 500 Index and US Recessions, 2000-2023. Source: St Louis FRED. Click for larger image

With a variable lag, equities tend to follow a monetary policy that has grown increasingly erratic with the explosion of leverage in the system since the turn of the century. Rather than smoothing the business cycle, the Fed’s attempt to manage the unmanageable appears instead to have increased the volatility of the economy and asset prices, giving rise to an “Equity Crisis Cycle” that mirrors the increasing amplitude of economic booms and busts.

The Equity Crisis Cycle. Source: TCM. For illustrative purposes only

While the stock market has risen across this century’s cycles, to actually capture these gains has required either nerves of steel or some way to address the acute crisis phase that so often creates allocation errors that can permanently derail an investor’s long term results. This is where hedging comes in.

continuous hedging: no free lunch

By far the most popular of these methods is to own protection continuously like an insurance policy, usually in the form of put options which offer a predetermined floor or “strike price” below which a portfolio is protected from losses. Not unlike insurance, this approach seems intuitive- until it is actually implemented.

To begin with, there are several variables besides the strike price that affect an option’s price and protective capability. This includes a steady erosion in value simply as of function of time until a contract’s expiration, at which point it must be replaced by one with a new set of variables and most often, a higher price. Compounding the issue, many strategies elect to “roll” their options coverage quarterly or even monthly.

If this sounds like an expensive proposition, that’s because it is. Though individual contracts may well benefit a portfolio during market declines, the cumulative cost of maintaining a continuous series of such contracts ultimately makes continuous hedging a losing prospect that nearly guarantees the portfolio’s underperformance over time (chart).

Growth of $1000, Option-Hedged Equity strategies vs S&P 500 TR, Nov 2016 - Oct 2023. Source: Yahoo Finance. “Option-Hedged Equity Strategies Composite” is an equally-weighted composite of JP Morgan Hedged Equity (JHEQX), Swan Defined Risk (SDRIX) and Gateway Fund Cl A (GATEX), rebalanced monthly.

crisis hedging: A new profile

Instead of sacrificing long-term performance with expensive hedging around the entire cycle, a tactical hedging strategy seeks to improve results by reserving hedges for the crisis period itself. While perhaps not as intuitive as options “insurance”, this approach holds the promise of simultaneously addressing the crisis issue while flipping the hedging cost / benefit equation positive over a full cycle (concept chart below).

VIX Crisis Hedging Concept. Source: TCM. Stylized example for illustrative purposes only.

At TCM, this is accomplished through a novel approach that 1) uses VIX exposures that strip away all options variables except for volatility and 2) deploys these exposures only when, according to signals from the VIX marketplace, conditions are right for a market crisis.

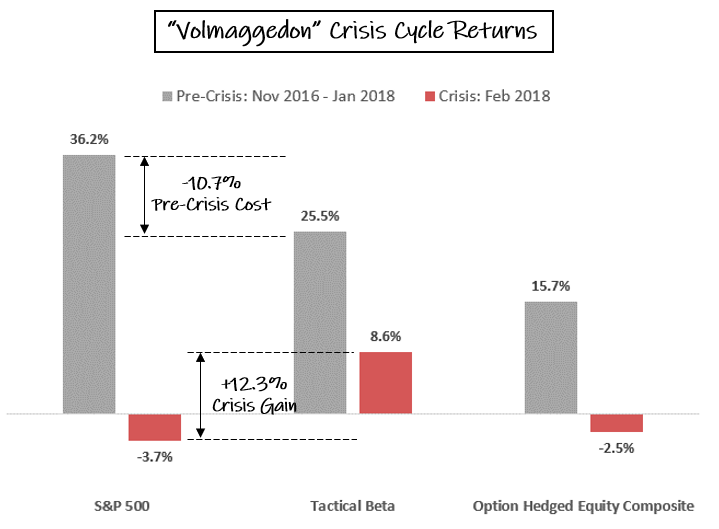

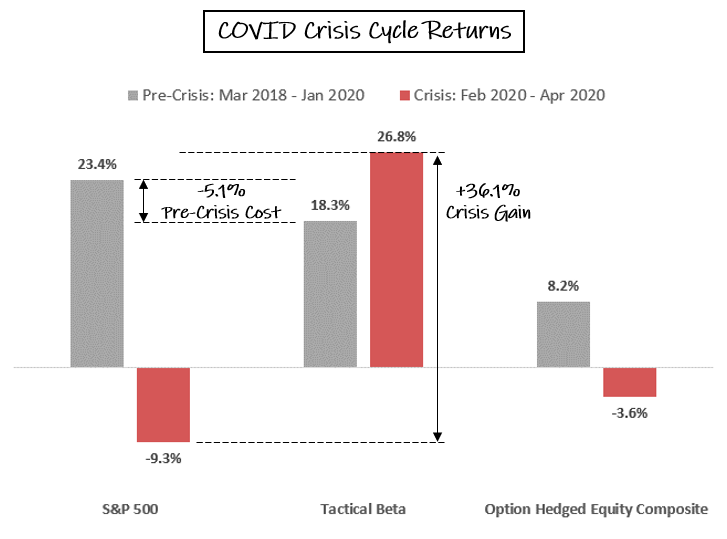

Of course, a new focus, strategy and hedging instrument naturally brings a new return profile. In pre-crisis markets (depicted in black above), each near-crisis or “false start” in VIX is expected to create hedge expense when contracts are purchased and sold at a loss as crisis conditions gather and then dissipate. In this period, hedge expense is controlled by cutting VIX losses after each false start and- a feature not available with continuous hedging- through periods with no hedging cost whatsoever.

By controlling hedge expense and staying disciplined with its deployment criteria in pre-crisis markets, this method reliably gains exposure to the true crisis-period VIX moves that can produce profits in excess of the cumulative pre-crisis expense (see slideshow).

Crisis Cycle Return Comparisons. Source: TCM, Yahoo Finance. Click arrows to advance slideshow

Putting it all together, if each cycle ends with a higher stock market and produces VIX profits, then a strategy using these pieces in combination should end up ahead over time. This is precisely what has been observed with Tactical Beta since its inception nearly seven years ago (chart).

Growth of $1000, Tactical Beta, Option-Hedged Equity strategies and S&P 500 TR, Nov 2016 - Oct 2023. Source: TCM, Yahoo Finance. “Option-Hedged Equity Strategies Composite” is an equally-weighted composite of JP Morgan Hedged Equity (JHEQX), Swan Defined Risk (SDRIX) and Gateway Fund Cl A (GATEX), rebalanced monthly. Tactical Beta net of all expenses and 1% management fee.

THE current cycle: nearing an end?

Current Crisis Cycle Return Comparison, Fall 2023. Source: TCM. Click for larger image

Today, the pre-crisis portion of the current cycle has been running for over three years with unusual pre-crisis VIX behavior even in the face of 2022’s significant drop in stocks contributing to a cumulative hedge expense in Tactical Beta that is on par with continuous hedging (chart).

Though it may be hard for those who invested after March 2020 to believe, we expect this cycle to ultimately end profitably like the others before. Based on history, this crisis period will occur as the result of a credit event set up by a sharp interest rate adjustment and brought on by recession. Using that framework, this end of this cycle promises to be an historic one: