no worries

Despite a pickup in inflation that pushed expected rate cuts out in time and down in magnitude, stocks continued to rally in February on an “AI” narrative that was only amplified by strong earnings from industry heavyweight Nvidia. Breaking with recent precedent, February’s gains were notably widespread with participation from international indexes (MSCI Emerging Mkts +4.6% Feb, MSCI EAFE +1.8% Feb) and outperformance from the small cap Russell 2000 index (+5.7% Feb) which finished the month ahead of the larger and tech-dominated S&P 500 (+5.3% Feb) and Nasdaq 100 (+5.3% Feb) indexes.

VIX futures prices 2/29/24. Source: vixcentral.com. Click for larger image

As expected in a broad-based rally, the VIX marketplace remained in a bullish configuration during the month with low VIX prices and an upward-sloping VIX futures curve continuing to indicate little near-term concern, though with a noticeable bump around the election later this year (chart).

In the center of the “perfect storm” of easing interest rate pressures and spiking AI earnings, TCM’s Hedged Disruptor strategy soared 18.5% in February to bring its total return since last November’s peak in rates to nearly +50% (chart below) while index strategies Tactical Beta (+5.0% Feb) and Tactical Q (+5.1% Feb) continued to ride the bullish wave, capturing nearly all of the month’s and year’s benchmark gains. Highlighting an important aspect of the strategy, Tactical Beta’s focus on minimizing hedge expense during bull markets has seen the portfolio capture 70% of the past year’s gains in the S&P 500 versus 52% for its hedged equity peers*.

*Equally-weighted composite of JP Morgan Hedged Equity (JHEQX), Swan Defined Risk (SDRIX) and Gateway Fund A (GATEX), rebalanced monthly

Growth of $1000, 11/1/23 - 2/29/24. Source: TCM, Yahoo Finance

As disappointing inflation data sent the benchmark 10 year US Treasury yield back over 4%, bonds reversed a good portion of their recent rally in February with the Bloomberg Aggregate Bond Index declining for a second consecutive month to end down -1.6% on the year. Highlighting its income diversification utility, TCM’s option income portfolio Hedged Yield (+1.3% Feb) rose with stocks in February while producing a substantial 12.7% net annual distribution yield without much of the interest rate risk that has been dragging on bonds.

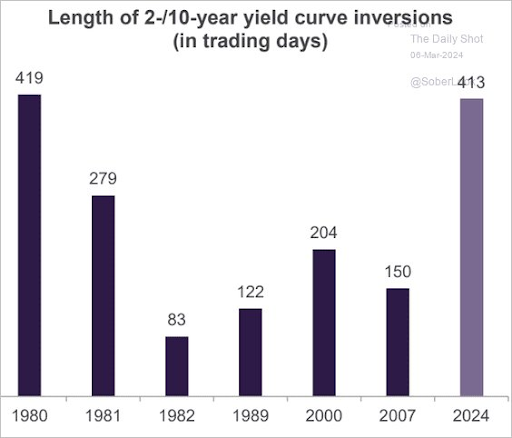

Meanwhile, market divergences continue to mount with a striking disconnect between global economies and stock markets including US stocks at all time highs despite a near-record duration of Treasury yield curve inversion (chart) while Japan and much of Europe’s stock markets also sit at record highs despite economies that are officially in or very near recession.

While markets may currently be supported by the rise of passive strategies that invest new money without regard to fundamentals, this same dynamic could also run in reverse should employment and its associated flows falter. As bullish sentiment continues to rise, we will stay trained on the VIX for signs of the next crisis which can come sooner than most believe.