Ace In The Hole

Expected Rates (SOFR) path. Source; Atlanta Fed. Click for larger image

After some turbulence to start the month, equity indexes rallied to fresh highs in August (S&P 500 +2.0%, Nasdaq 100 +0.9% Aug) as a much-anticipated speech by Jay Powell at the Fed’s Jackson Hole symposium cemented expectations for a September rate cut (chart).

Though the market’s tepid response hinted at overly-optimistic expectations for the company specifically, solid quarterly results from bellwether Nvidia (NVDA) lent support in August the wider “AI Capex” narrative that continues to propel earnings estimates and stock markets higher (more on this below).

Aside from modest hedge expense around the month’s early “false alarm”, TCM strategies saw index-like results in August led by Emerging Markets Smart Index which is now up every month in 2025 and +20.2% YTD while in a testament to the remarkably consistent cost / benefit advantage of tactical versus passive risk management, Tactical Beta remains ahead of its Hedged Equity peers* in 2025 as well as over each of the trailing 1, 3, and 5 year periods and since inception (chart).

Net returns as of August 2025. Source: TCM, barchart.com. Returns greater than 1 year are annualized. *HE Peers is an equally-weighted composite of JP Morgan Hedged Equity (JHEQ), Gateway Fd A (GATEX) and Swan Def Risk (SDRIX)

robots All The Way Down

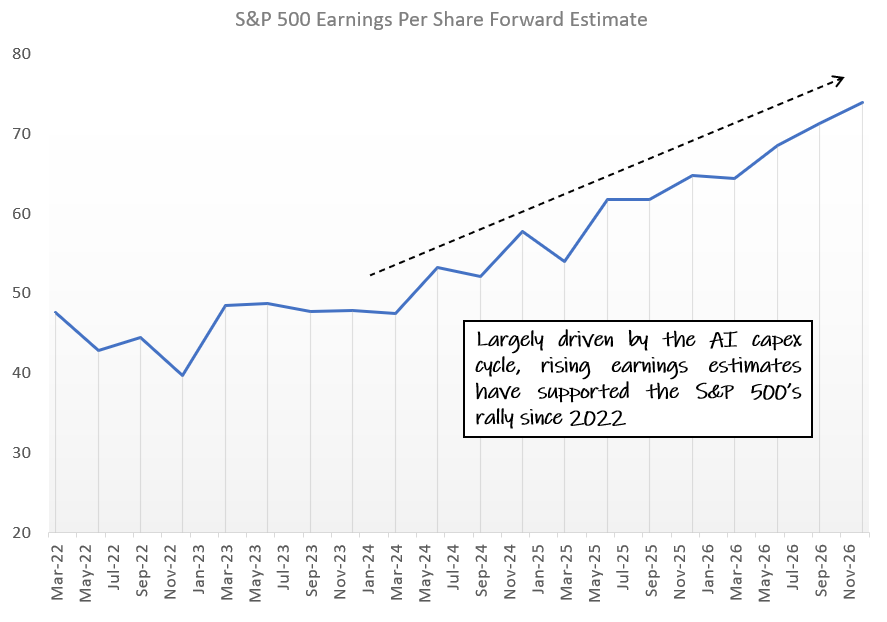

Since 2022, equity markets have risen in tandem with earnings estimates (chart) that are mainly a function of an AI capex boom that is itself based on high expectations for the technology’s future adoption. To a degree rivaling the “dot com” era, this has left equities increasingly reliant on the prospects of a single technology as it continues to drive concentration and valuation to record levels.

S&P 500 12m Fwd Earnings Estimates. Source: ycharts.com

In other words, it is becoming apparent that AI is both a blessing and a curse for markets- supporting today’s returns while storing potential energy for tomorrow’s volatility, positive or negative. Especially when faced with such a sizeable range of possible outcomes, we believe that a tactical approach is likely to have highest odds of success in the coming years.