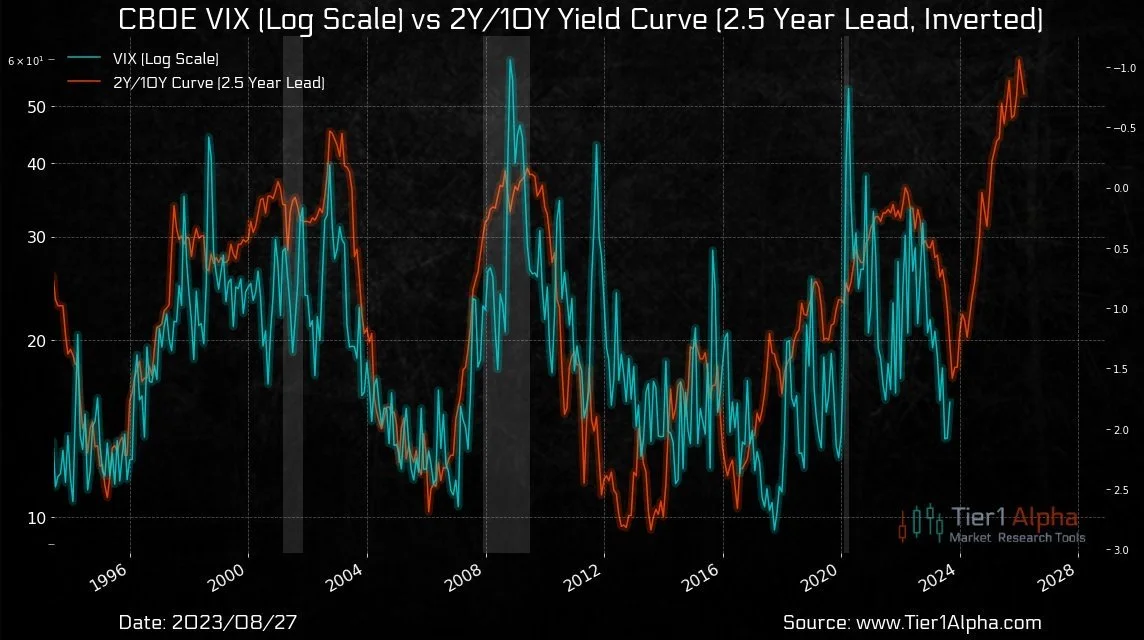

As we have repeatedly suggested, the best time to own a crisis-focused strategy is just ahead of the next crisis. History suggests that we may now be on the precipice of one.

Managing The Equity Crisis Cycle

Equities follow a repeating cycle of crisis periods created by monetary policy. If each cycle ends with a higher stock market and produces VIX profits, then a strategy using these pieces in combination should end up ahead over time. This is precisely what has been observed with Tactical Beta since its inception nearly seven years ago… we expect this cycle to ultimately end profitably like the others before.